Some of the best-known investors of the last century have been value oriented. Benjamin Graham, Joel Greenblatt, and Warren Buffet have each emphasized investing in companies that trade at a low price relative to the value of their assets or steadiness of earnings. Despite this fact, the value play has been suffering ever since the recovery from the Great Recession. Instead, the strategy to make money during this last decade has been simple: load up on cheap debt and buy mega-cap growth (likely tech) stocks. While this stretch of underperformance has been painful, there are several reasons to believe now could be a good time to add value to a portfolio. First, the premium to invest in growth stocks is larger than ever before. Second, value tends to outperform growth during the recovery period from recessions. Finally, value stocks offer a way to get equity exposure at reduced volatility for those investors who are still leery about adding risk after the Coronavirus sent markets tumbling in February and March. Any or all these reasons could act as a catalyst for a resurgence in value stocks.

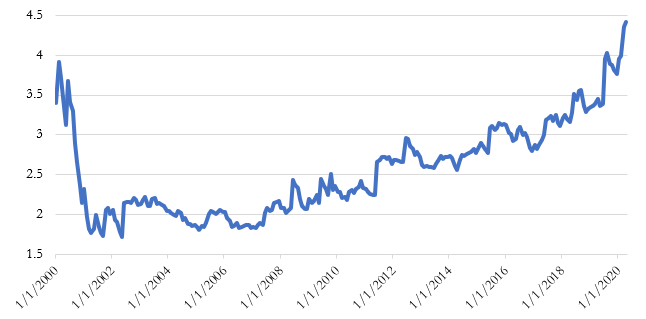

In terms of growth premiums, this is one of the most expensive markets ever on both an absolute and relative basis. For example, the value-spread, which shows the price-to-book multiple of growth stocks relative to value stocks, is almost double its historical average. Companies in the Russell 1000 Growth Index were trading at a PB ratio of 7.3 at the end of April, more than 4.4 times the PB ratio of Russell 1000 Value stocks. Going back to the turn of the century, growth stocks have usually traded at a premium of about 2.5 times that of value stocks (see Figure 1 below).

Figure 1: Growth Premium of Russell 1000 Companies

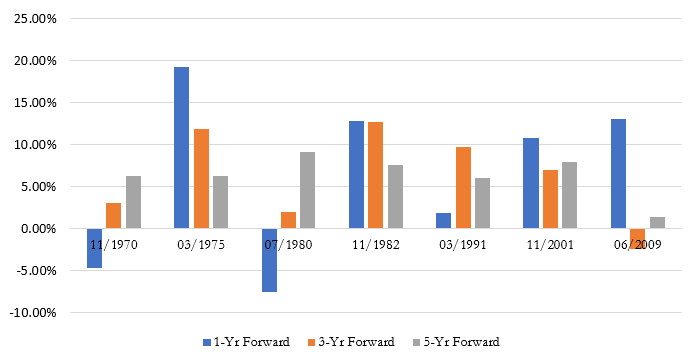

The current recession could be the tipping point for which the growth premium reverses its trend and moves back closer to its historical mean. Historically, value has tended to outperform growth coming out of a recession (see Figure 2 below). Most forecasts anticipate positive Q3 GDP growth after what figures to be one of the worst quarters on record in Q2.

Figure 2: Annual Excess Return of Value Factor Coming out of Recessions

Value strategies may be poised to outperform, but there are some drawbacks to the traditional value play that should be considered. One major concern is that using price-to-book ratio to capture value no longer works as well as it once did since the “value” in companies is increasingly coming from intellectual property and branding rather than physical assets. Instead of price-to-book, focusing on securities with low price-to-earnings and high return on equity characteristics has improved returns for the value model.

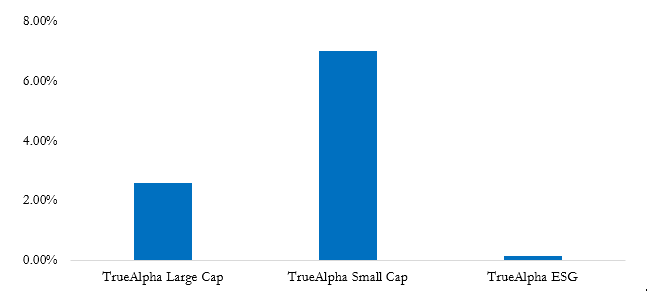

Julex Capital, and their adaptive investment philosophy, have three quantitative equity strategies that select undervalued companies (low P/E) relative to their quality (high ROE implies improvements in profitability, efficiency, or leverage). This approach has led each of Julex’s three value strategies to outperform their benchmark since inception (see Figure 3 below).

Figure 3: Annualized Excess Return of Julex Strategies Since Inception*

Disclosure: This article is for the purpose of information exchange only. It is not a solicitation or offer to buy or sell any security. You must do your own due diligence and consult a professional investment advisor before making any investment decisions. All information posted is believed to come from reliable sources. We do not warrant the accuracy or completeness of information made available and therefore will not be liable for any losses incurred.