Julex Capital has developed a TrueAlpha™ Multi Factor stock selection model to create a concentrated portfolio aiming to generate a significant alpha over index with high active shares and tracking errors. The TrueAlpha™ stock selection model has two distinct features:

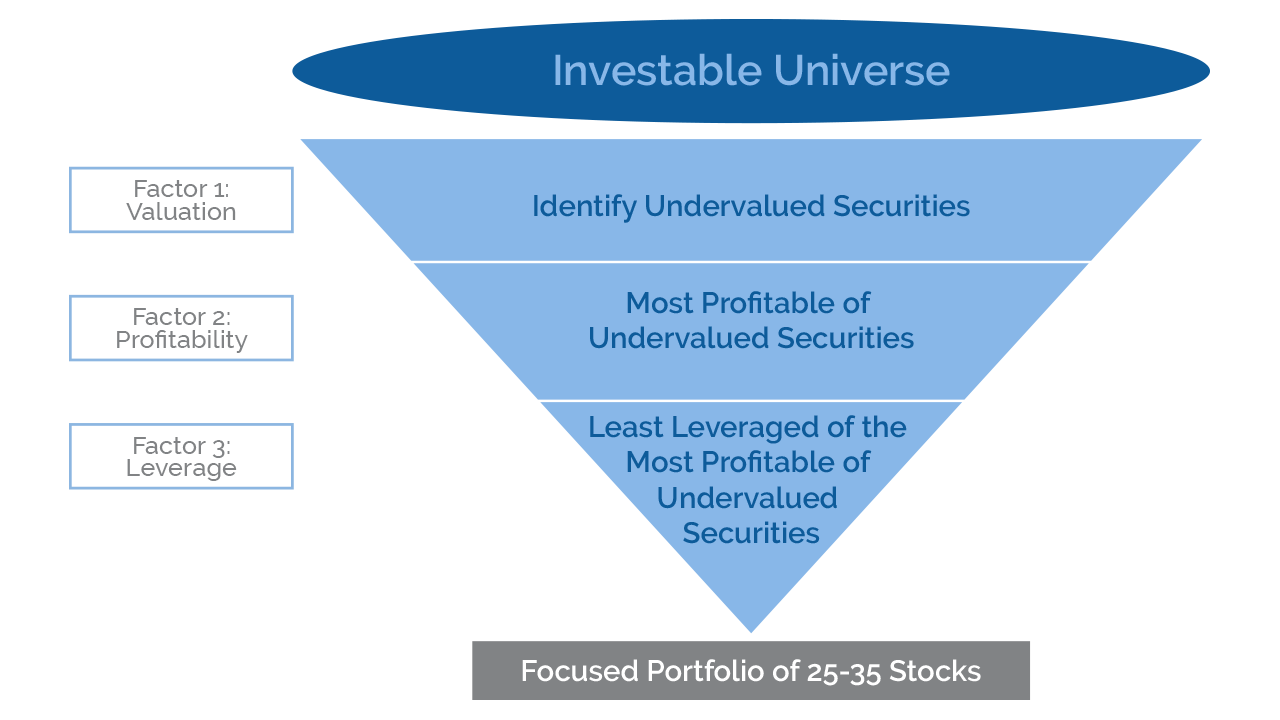

- Sequential factor screening. In contrast to most quant models with a linear combined score, our model screens stocks sequentially by each individual factor.

- Stock selection alpha. Unlike most quant models, the excess returns generated from our model are uncorrelated to the Fama-French risk factors like size, value or momentum.

The model is derived from a fundamental stock valuation formula. It uses a proprietary valuation metric, profitability and leverage factors to determine the attractiveness of the individual stocks. The portfolio is composed of 20-40 “undervalued” high-quality stocks. The quantitative model is run every three months.