In the past 10 years, smart beta has become one of the fastest growing investment segments. Being called by different names such as strategic beta, fundamental indexing or factor investing, smart beta represents rules-based strategies that aim to deliver better returns than traditional market-cap-weighted indexes by selecting stocks or using different weighting schemes based on fundamental factor(s).

The growth of the segment has been impressive. Blackrock reported the total ETF assets under management with smart beta strategies reached $282 billion as of May 2016, and predicted that smart-beta ETF assets would quadruple to $1 trillion by 2020. Despite its increasing usage, every investor should ask if smart beta can really deliver on its promise.

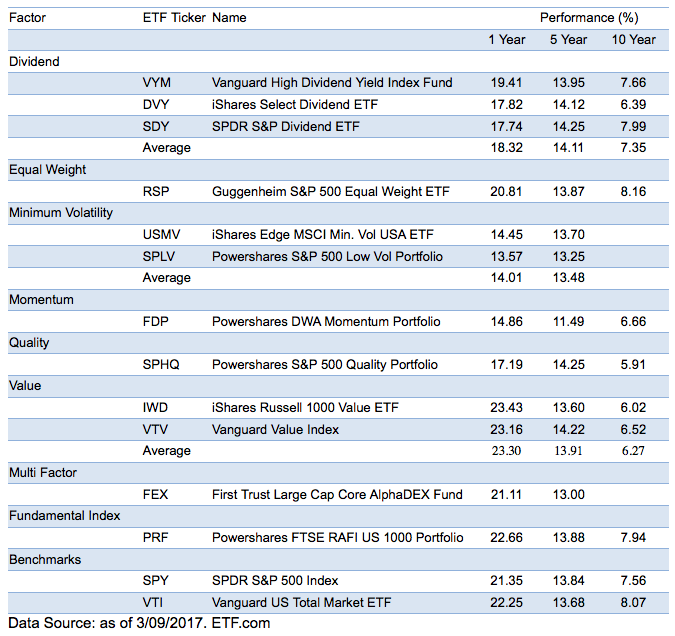

Table 1. Performance of Some of the Most Popular Smart Beta ETFs

Most of the smart beta ETFs have short track records, which make it harder to evaluate their performance. Here, we will examine some of the most popular smart beta ETFs with at least $1 billion AUM and the longest history. Table 1 shows the performance on 1-year, 5-year and 10-year horizons for different types of smart beta ETFs. Normally, smart beta strategies use a single factor or multi factor models to select securities and/or create different weighting schemes from cap-weighted indexes. We will discuss each of the factors and the performance of their related ETFs.

- Dividend – This strategy aims to capture excess returns by investing or over-weighting stocks with higher dividend yields. The most popular ETFs in this category are VYM, DVY and SDY. The average ten-year return of them is slightly lower than those of SPY and VTI.

- Equal-Weighted Portfolio – This strategy aims to capture the size effect, which states that stocks with smaller market capitalization tend to outperform the stocks with larger capitalization. Compared to a cap-weighted portfolio, an equal-weighted portfolio over-weights stocks with smaller caps. The most popular equal-weighted ETF – RSP – outperformed SPY and VTI slightly over a ten-year horizon.

- Minimum Volatility – This strategy aims to generate alpha through investing or over-weighting stocks with below-average volatility and beta. Empirical academic researches show there exists a low volatility premium historically. However, the average five-year return of the two most popular low-volatility ETFs – USMV and SPLV – is slightly lower than those of SPY and VTI.

- Momentum – This strategy aims to generate excess returns by investing or over-weighting stocks with the strongest price momentum, which is measured by price return in a certain period. The popular momentum ETF – FDP – underperformed SPY and VTI in past ten years.

- Quality – This strategy aims to capture excess returns by investing or over-weighting stocks with good “qualities” such as low leverage, stable earnings, high return on equity, etc. The longest-running ETF in this category – SPHQ – underperformed both SPY and VTI.

- Value – This strategy aims to capture the value premium by investing or over-weighting stocks that are “cheap” based on P/E, P/B or other valuation metrics. The value ETFs have the longest history. Two of the most popular value ETFs, IWD and VTV, underperformed SPY and VTI in past ten years.

- Multi-Factor – This strategy aims to generate alpha by investing or over-weighting stocks selected by a quantitative model incorporating various factors like value, size, quality, momentum, etc. The longest running multi factor ETF – FEX – slightly underperformed SPY and VTI in past five years.

- Fundamental Indexing – This strategy is similar to the multi-factor strategy. Instead of weighting them based on their market capitalization, stocks in the portfolio are weighted based on a multi-factor fundamental score. The first ETF using Research Affiliate Fundamental Index – PRF – performed in line with SPY and VTI in last ten years.

Based on the performance records of different type of smart beta ETFs, the answer to whether smart beta can deliver better returns than cap-weighted indexes is not clear cut. It is unrealistic to expect outperformance by just picking any smart beta ETF.

However, smart beta continues to be one of the most innovative investment segments. More managers and more smart beta ETFs are entering the market constantly.

New factors are being utilized and new models are being created. To achieve a good investment result, investors who are interested in smart beta strategies should perform careful analysis and thorough due diligence.

[fny id=”1″]