In the first 29 months of the Trump presidency, the S&P 500 has risen by about 11.3% annually through June 30th. On one hand, this beats the long-run (50-year) average of the market by 4.25%. On the other hand, this performance is not especially noteworthy considering the steepness of the recovery from the housing bubble; the S&P saw 22.72% annual appreciation for the first 29 months of Obama’s presidency, and 13.84% annual appreciation over the entirety of his eight years in office. Is this a sign that the long running bull market is leveling off and that the economy is growing stale? To think about why a recession could be imminent, we’ll examine three top economic indicators: GDP growth, jobs numbers, and the aforementioned stock market.

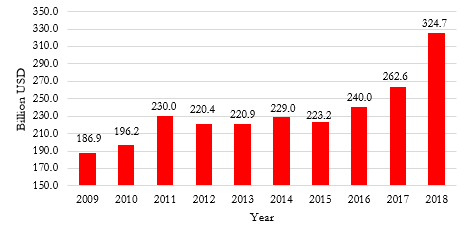

Annualized QoQ GDP growth has chugged along between 2.2 and 4.2% each quarter since Trump took office. The US Economy is consumer driven, so while growth appears strong on the surface, it’s slightly disconcerting that the consumer segment grew at just 0.9% in Q1 2019, the lowest level since 2012. To make up for this, government spending grew at 2.8%, its highest level since 2016. Taken by itself, this isn’t inherently bad. But when one considers the fiscal policies at the federal level, the 3.1% annualized growth rate looks less impressive. In 2018, the country brought in about $3.3 trillion in tax revenue and spent about $4.1 trillion, borrowing the $800 billion difference. Three percent growth on an annual GDP of about $21 trillion is $630 billion, meaning that without the $800 billion in debt-spending, the economy would be contracting, not expanding. As the saying goes, there’s no such thing as a free lunch—sooner or later the growing debt load that’s sustaining our economic growth will come due (see Figure 1).

Figure 1: Post-Crisis Interest Payments on Debt

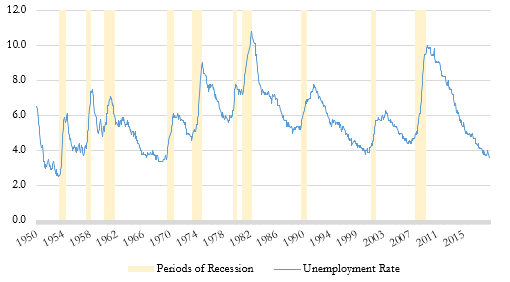

Meanwhile, headline unemployment is at its lowest level in 50 years, sitting at a miniscule 3.6% at the end of June. But job prospects may be worse than the headline number indicates. For example, the labor force participation rate has sat between 62.5% and 63% for the better part of the last 5 years, which is well below the pre-crisis levels of about 66%. Another counter-intuitive point to consider is that a low unemployment rate may actually be indicative of a coming recession. This is because historically speaking, unemployment rarely flatlines—it’s usually trending one way or the other (see Figure 2). Since the start of a recession has been preceded by the bottoming of the unemployment rate with an uncanny degree of accuracy, the question then becomes whether or not unemployment can continue to shrink.

Figure 2: U.S. Unemployment Rate and Recessionary Periods

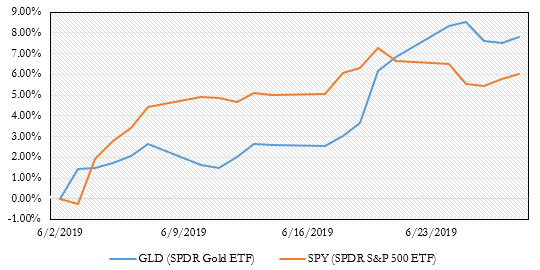

The stock market has been an especially fragile indicator. There’s no doubt that the market has continued to climb, but this growth hasn’t come without some notable question marks as to its legitimacy. Maybe most glaringly is the disconnect between lagging earnings growth (Q1 earnings fell 0.4%) and the price of the stock market (the S&P rose by about 13% in Q1). Especially considering the preferential tax treatment of capital gains, it would be one thing if companies were forgoing profits and electing to invest a growing revenue stream into capital expenditures. But that hasn’t been the case– aggregate revenue growth has slowed, and corporate buybacks are on pace for a record year.

Further, many contrarian indicators are flashing. Retail investors have been pouring into the stock market, and gold, the vaunted safe haven from risky assets, has had a great June. The simultaneous increase in the stock market and a demand driven, store-of-value commodity like gold may signal investor’s weariness at an equity market that’s perceived to be driven by speculation (see Figure 3).

Figure 3: June Gold Rally

Of course, the current expansion can’t go on forever. We’re already seeing weakness in global growth, and the sensitivity of the market to small movements in the already minimal interest rate environment may be a telling sign that an accommodative Fed and easy money is holding up the market. The difficult part for investors is judging when the market will reverse course and determining the difference between short-term movements and the start of meaningful trends. This is why tactical strategies with an emphasis on down-side protection may make sense for some investors. If you’re interested in learning more about such strategies, please reach out to our team. You can find our contact information on our web page.

Disclosures

Julex Capital Management is a SEC-registered quantitative investment management firm specializing in tactical and factor-based investment strategies. The firm offers a variety of tactical unconstrained investment solutions aiming to provide downside risk management while maximizing the upside potentials using its unique Adaptive Investment Approach. In addition, Julex offers active equity strategies to deliver security selection alpha uncorrelated with the traditional risk factors like size, value or momentum using its TrueAlpha (TM) multi-factor sequential screening approach.

The information in this presentation is for the purpose of information exchange. This is not a solicitation or offer to buy or sell any security. You must do your own due diligence and consult a professional investment advisor before making any investment decisions. The risk of loss in investments can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition.

The use of a proprietary technique, model or algorithm does not guarantee any specific or profitable results. Past performance is not indicative of future returns. The performance data presented are gross returns, unless otherwise noted.

All information posted is believed to come from reliable sources. We do not warrant the accuracy or completeness of information made available and therefore will not be liable for any losses incurred. No representation or warranty is made to the reasonableness of the assumptions made or that all assumptions used to construct the performance provided have been stated or fully considered.