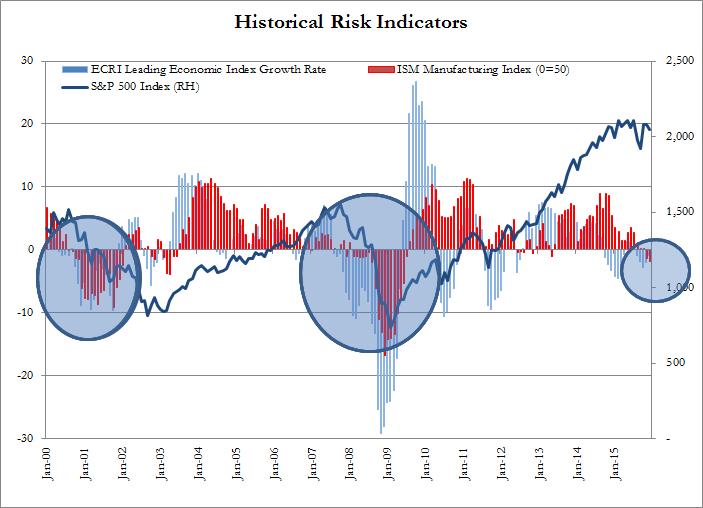

At Julex Capital, we run a three step quantitative model the first of which determines the market environment, we call it the RiskSwitchTM. The RiskSwitchTM looks at various market indicators to determine the overall investment environment. The chart below is an example of two of the economic indicators we use to determine the health of the US market. Historically when the leading economic index and ISM both turn negative, the market has traded off as indicated by the highlighted periods. These two indicators have not been trending lower together, for any meaningful length of time, since the financial crisis. So far we are only looking at two months (Nov. and Dec.) of negative data, but coupled with the increased volatility we saw at the end of last year and now early this year, along with this month’s market performance… this could be a dark tunnel before we see any daylight.

At the last model run in the beginning of January, the ‘risk-off’ signal was triggered and our strategy is now defensively positioned. This is the first time this has occurred since we went live in 2012.