The US equity market had the worst December since 1931. Uncertainties about the trade war, fears of slow global economic growth, unexpected hawkish Fed statements and a partial government shutdown unsettled investors’ appetite for risk. Investors rushed to safe assets. International stocks struggled as well.

In its December meeting, the Fed raised interest rates by a quarter point, as expected, and lowered its median rate forecast to two hikes from three next year. But the central bank retained the language in its statement that the market saw as more hawkish than expected. What scared markets more was that Fed Chairman Jerome Powell stated the Fed was satisfied with its program to reduce the balance sheet and it has no plan to change it. Investors considered the Fed’s quantitative tightening stance as a negative factor for the stock markets.

Additionally, many analysts expect a deceleration of economic growth in 2019 driven by tariffs, the fading impact of the tax cuts and higher borrowing costs caused by the Federal Reserve. Globally, tariffs and other protectionist policies are likely to hurt the economic growth in emerging market countries next year. The US GDP growth is on pace for 3% this year, but it is expected to slow down to around 2% next year.

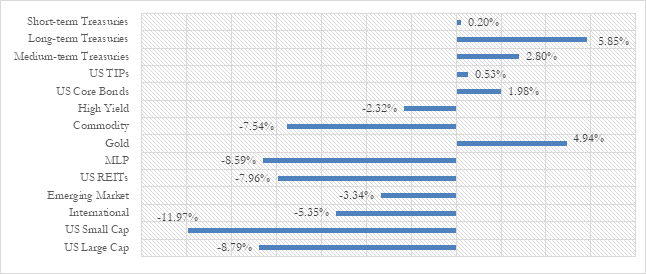

Figure 1: Asset Class ETF Performance – December 2018

The S&P 500 SPDR ETF (SPY) tumbled by 8.79%, while the small cap stock ETF (IWM) performed worse, down by 11.97%. The emerging market equity ETF (VWO) fared better, down by 3.34%. Gold (GLD), as a safe-haven investment, rallied 4.94%. The fixed income asset classes generated strong positive returns. The long-term Treasury bond ETF (TLT) jumped by 5.85% (see Figure 1). Market volatility, as measured by the S&P 500/CBOE option implied volatility, rose to 25.42% on December 31.

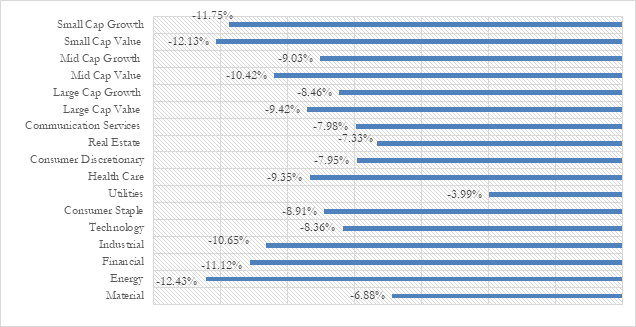

All the sectors suffered significant losses. Energy (XLE) was the worse sector amid declining oil prices, falling by 12.43%. Financials (XLF) also dropped by 11.11% as yield curve was flattening and potentially hurt banks’ profit margin.

Figure 2: Equity Sector ETF Returns – December 2018

Data Sources: FactSet