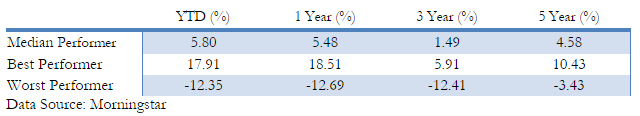

Tactical asset allocation (TAA) is a dynamic strategy that actively adjusts the asset weights in a portfolio based on the manager’s short term market views. It is normally used as a complement to a strategic allocation in order to improve the risk/return profile of the total portfolio. Historically, TAA provides an efficient and cost effective portfolio solution for managing downside risk. Therefore, following the financial crisis of 2007-2008, there was a renewed interest in these strategies as investors searched for better risk management tools. As shown in Figure 1, median TAA managers helped limit losses during down markets over the last ten years, which led them to outperform the MSCI World Equity Index over the same time period.

Figure 1: Historical Returns of Median Tactical ETF Strategy vs. MSCI World Index

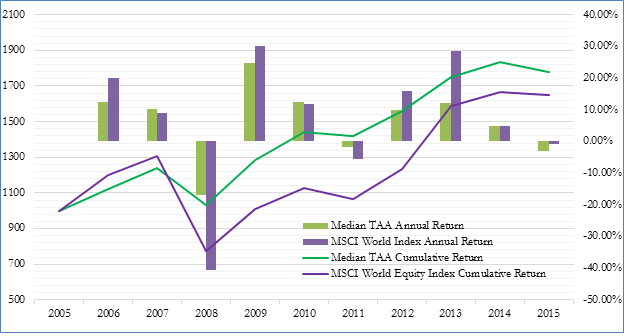

However, individual performance of TAA managers differ significantly. There are big gaps between the best and the worst performers (see Table 1). Given the flexibility of the TAA mandates, a wide range of performance records across managers is expected. To achieve investment success, it is extremely important for investors to select a good manager.

Table 1: Performance of Morningstar Tactical Allocation (12/30/2016)

Most of the TAA managers utilize quantitative model-driven strategies. To evaluate a TAA strategy, investors first need to understand the rationale of the variables used in each manager’s model. There are four different types of variables most commonly used in TAA models.

- Business cycle/economic indicators. Asset class performance is related to economic performance. Normally, stock markets perform well during an economic expansion, and bond markets perform well during a recession. Commodity prices rise during inflationary periods, and Treasuries and other fixed income assets rally in the deflationary or disinflationary periods. Numerous economic indicators, such as GDP, CPI, consumer confidence, industrial production, etc., can be used to build models to identify or forecast economic regimes and asset returns in the TAA process. The major drawback of using economic indicators as the only variable is that most are lagging and not very useful in predicting market performance. One has to be very picky when selecting economic indicators.

- Fundamental valuation data. Fundamental stock market valuation metrics like price-earnings ratio (PE) or price-to-book ratio (PB) have a tendency to revert to the mean over the long run. When the market is expensive based on the historical standard, it may decline to become more reasonably priced. However, valuation is generally not a very good timing indicator by itself because the market can stay over or under valued for a long time.

- Market trend and momentum. Financial markets trend up and down, following a boom and bust cycle as the economy moves between expansion and recession, and monetary policies swing from tightening to loosening cycles. Investors tend to under-react or over-react to the market fundamentals, causing market trends to last longer than otherwise. TAA managers use moving average, rate of change or relative strength to model trends. In general, trend-following strategies work well in the long run, but may suffer meaningful losses from time to time when the markets become volatile and trendless.

- Sentiment signals. Market sentiment indicators can be used either as trend confirmation or as contrarian signals. When both market trends are positive and sentiments are improving, investors should feel more comfortable with taking more risk. When the sentiment signals reach extremes, investors may take a contrarian position to benefit from market reversals. Sentiment signals such as credit spread, implied volatility or margin borrowing are used in allocation models. However, it’s not easy to determine how extreme the market sentiment can become.

Secondly, investors need to understand the approaches a manager takes in building their models. TAA managers frequently use three approaches or some combination of them to help their investment decisions.

- Forecasting model. The most traditional way to tactical asset allocation starts with a forecast of asset class returns. The manager would overweight the asset classes with the best forecasted returns and under-weight the asset classes with the worst forecasted returns. There are many different ways to forecast asset class returns. Some managers utilize fundamental indicators, some utilize technical indicators, while others utilize both type of indictors in their models. Linear models, as well as, non-linear models are used in forecasting. No matter what variables or what type of the model a manager uses, predicting short-term market returns accurately is such a difficult task that very few can master it.

- Trend-following/momentum model. The trend-following/momentum strategy starts with identifying market trends, then a manager over-weights the asset classes with positive trends and under-weights asset classes with negative trends. Managers can use short horizon, long horizon, a combination of both or a varying-horizon to identify trends. In general, the strategy performs well in the trending markets, up or down, but may underperform in a volatile trendless market.

- Regime switch model. The regime switch model aims to identify market regimes and then overweigh the asset classes expected to perform well in the identified regimes. Like forecasting models, a regime-switch model can incorporate both fundamental and technical indicators. Managers often define regimes differently. Some use two regimes such as “risk on” and “risk off “; some use four regimes like high growth/high inflation, high growth/low inflation, low growth/high inflation and low growth/low inflation. Usually, in a positive or negative economic and market environment, it is easier to identify a regime. However, during the transition or uncertain periods when the signals are mixed, it becomes harder, and thus the strategy could potentially underperform in those periods.

All three approaches have their own pros and cons. Even managers who use the same approach may have very different models. Variables, parameters, investment time horizons can vary significantly. In general, trend following and regime switch models tend to perform well in the trending markets, but underperform in volatile trendless markets. Performance of a forecasting model is more idiosyncratic. One model may perform completely different from the other.

In addition to understanding the rationale, the theory and modeling approach, investors need to evaluate the managers’ ability of implementing strategies and delivering strong performance consistently. There are four considerations here.

- Solid track record. A live track record is one of most important things in evaluating tactical managers. Live performance is the only real out-of-sample test of a tactical model. Many TAA models have spectacular back test results, but disappointing live records. This inconsistency between the back test and live record is an indication that the model may over-fit the data, thus have trouble performing in real time. A good model should show comparable results between the back test and live performance records.

- Back tests need to cover various market cycles. Many tactical managers do not have long-term track records; instead they show back-test performance. Drawbacks of back tests such as data-fitting and hindsight benefits need to be well understood. Further, some managers only offer back tested data for short periods of time. This is usually not sufficient to prove the legitimacy of the model. Investors need to see how the model performed over a few complete market cycles and understand when and why the model outperformed, as well as when and why it underperformed.

- Team experience. Many tactical managers, especially some ETF strategists, came to the market without long-term investment management experiences. Although they may be brilliant in developing quantitative models, they might face difficulties understanding why their model underperforms when market conditions start to change. To build long-term success, the TAA models need to continuously improve and adapt to ever-changing market conditions, and in those efforts, experience will prove to be the utmost of importance.

- Research capability. Tactical investing is not an easy task. TAA managers need to constantly improve models and develop new strategies. Firms that allocate more resources to research will have a better chance to deliver superior returns over longer periods of time.

In summary, finding a good manager is critically important for investors to achieve success or expected performance. It is even more true for selecting a tactical asset allocation strategy given the flexibility of the investment mandate and the big disparity of the performance. Understanding the rationale and modeling approach, knowing when and why the strategy performs and finding consistency between back test results and live track records are among some of the important tasks investors need to undertake.