Investment Process

Investment Process

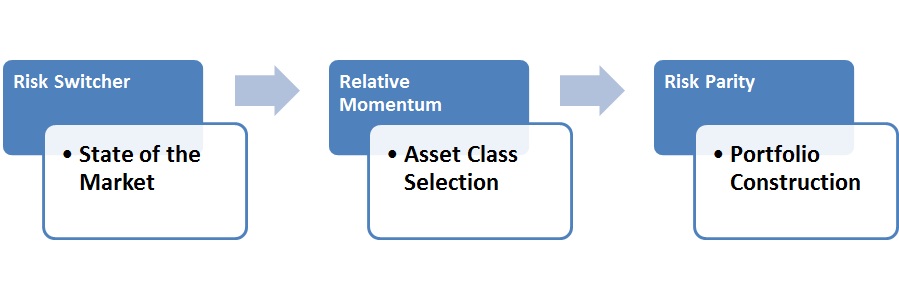

We believe capital preservation and capital growth are equally important investment objectives. To achieve our objectives, we have developed a three-step process based on our extensive experience and in-depth research. The steps include:

- Risk on/off switcher through a composite indicator including economic, technical and risk indicators;

- Asset class/sector selection through relative momentum;

- Risk parity approach to portfolio construction.

By dynamically rebalancing portfolios through the investment process, we achieve consistent returns by actively participating in the bull markets while limiting risk exposure in the bear markets.

Risk Switcher

By studying numerous economic, technical and market indicators, we have developed a composite indicator, called Risk Switcher TM, to help us identify the state of markets. In the “risk on” state, investors would like to take more risks and we over-weight risky assets such as equity, real estate and commodity. On the other hand, in the “risk off” state, we overweight safe assets such as high grade corporate bonds and Treasuries.