With rates having been so low for so long, savers have been hurt by the lack of available safe income in the market. Conventional wisdom says that these savers will either be pushed into risker assets or forced to take the historically low interest rates offered by low-risk debt. A more novel solution is also possible, however. Regardless of one’s portfolio make-up, utilizing option overlays is one way to provide consistent income with a low probability of loss.

One example is an iron condor strategy. This strategy writes out of the money puts and calls to produce income, and then buys deeper out of the money puts and calls to protect against losses. By buying and selling the options on an index, the income generated from the strategy is tax advantaged (60% long-term, 40% short-term) even though the options may be short-dated. Also, one need not own the index to use the strategy. Any portfolio can act as margin, and the maximum potential loss is defined at the outset of the trade.

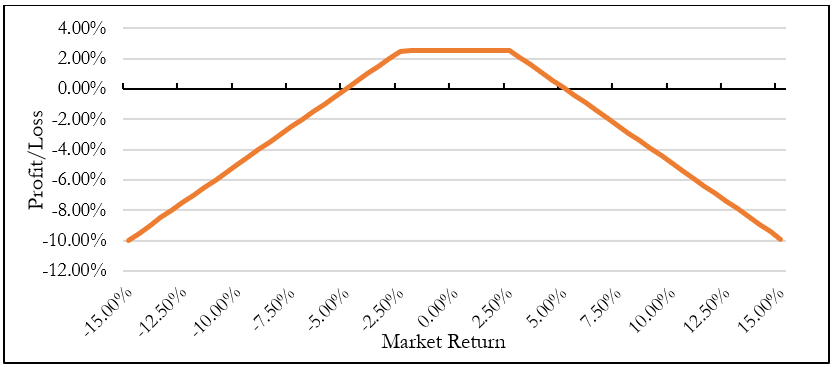

In an iron condor strategy, one first writes out-of-the-money (OTM) put and call options to generate income. A call option, which gives the owner the right (but not the obligation) to buy the underlying asset at an agreed upon price and date, is valuable when the strike price of the option is below the market value of the underlying asset at expiration. In contrast, a put option, which gives the owner the right to sell at an agreed upon price and date, has intrinsic value when the strike price of the put is above the market value of the asset at expiration. Figure 1 below shows the profit and loss diagram for a hypothetical trade consisting of the sale of one OTM put and one OTM call (called a short strangle).

Figure 1: Profit/Loss Diagram For Hypothetical Short Strangle

The call option had a strike price 2.5% OTM and was sold for 0.92%. The put option also had a strike price 2.5% OTM and was sold for 1.63%. Both options had the same expiration date. The strategy made the most money if the market was ±2.5% by expiration, but made money whenever the market was ±5%.

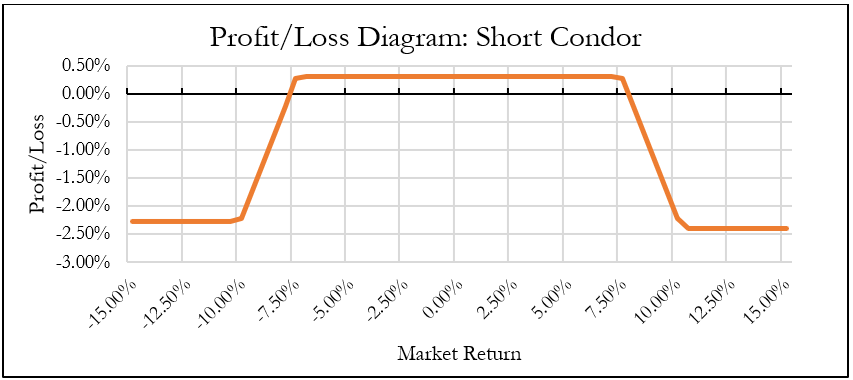

A drawback to this strategy is the presence of unlimited downside risk on either end of the strike prices. To combat this, a condor strategy will also buy deeper OTM options, which creates a defined downside at the outset of the trade. This is illustrated in Figure 2 below. The additive sum of the put and call spread is the maximum value of the trade, while the percentage difference in strike price between the bought and sold legs is the maximum loss.

Figure 2: Profit/Loss Diagram For Hypothetical Iron Condor

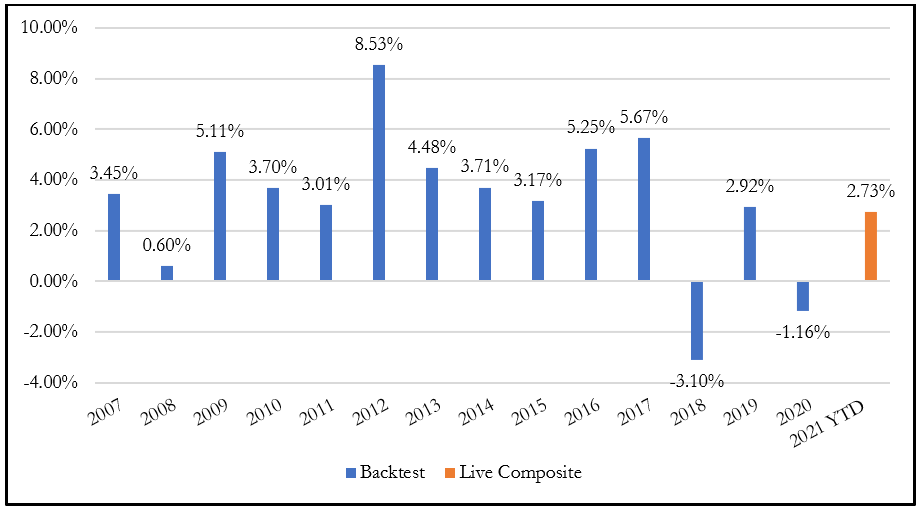

Julex Capital offers their version of the iron condor, the Enhanced Yield Strategy, which has low correlation with traditional assets and is negatively correlated with fixed income. The strategy is highly liquid with no lock-up period, offers a well-defined weekly risk budget, and can be implemented with no change to the client’s underlying asset allocation.

Figure 3: Model Performance Of Enhanced Yield Strategy

For more information, please contact Liam Flaherty (liam.flaherty@julexcapital.com).

Disclosure: This article is for the purpose of information exchange only. It is not a solicitation or offer to buy or sell any security. You must do your own due diligence and consult a professional investment advisor before making any investment decisions. All information posted is believed to come from reliable sources. We do not warrant the accuracy or completeness of information made available and therefore will not be liable for any losses incurred. Past performance is not indicative of future returns.