Despite the heightened volatility, equity markets ended November with a positive tone. Hope for the ease of trade tensions, more dovish view from the Fed and unsurprising mid-term election results all lifted the investors’ sentiments in the US. Globally, positive developments in easing trade tensions helped rally the EM equities, but uncertainties surrounding Brexit created headwinds.

The US mid-term election results were mostly in line with expectations. The Democrats took control of the House and the Republican expanded the majority in the Senate. Historically, a split congress is good for financial markets.

In his speech at the New York Economic Club, the Fed Chairman Jerome Powell said “Interest rates are still low by historical standards, and they remain just below the broad range of estimates of the level that would be neutral for the economy…” This “just below” language is different from the more hawkish “long way from neutral” characterization he gave at the beginning of October. The market rallied after his speech.

President Trump met with Chinese counterpart, President Xi, after the G20 summit in Argentina. They agreed to a burgeoning trade war on hold as both leaders said they wouldn’t impose new tariffs for 90 days while the world’s two largest economies negotiate a longer-term deal. The temporary truce was expected by the market participants and should rally the risk assets more in December.

Corporate earnings were strong in Q3, but more firms have lowered their EPS guidance. Among the 97% of companies in the S&P 500 Index reporting results, 78% have beaten earnings estimates and 61% have beaten sales estimates. The blended earnings growth rate for the S&P 500 was 25.9%, the highest rate since Q3 2010, according to FactSet. For Q4 2018, 68 S&P companies have issued negative EPS guidance and 31 have issued positive guidance.

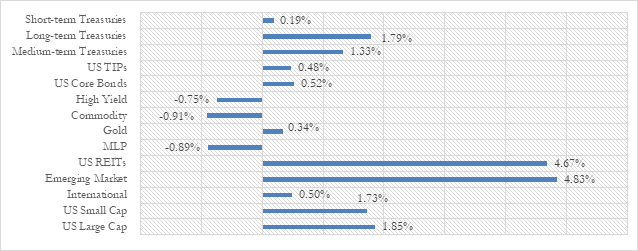

Figure 1: Asset Class ETF Performance – November 2018

Data Sources: FactSet

The S&P 500 SPDR ETF (SPY) moved higher by 1.85%, while the small cap stock ETF (IWM) rose 1.73%. The emerging market equity ETF (VWO) was the best performer, up by 4.83%. Gold (GLD) rose slightly. The fixed income asset classes generated positive returns amid the more dovish tone from the Fed. The long-term Treasury bond ETF (TLT) went up by 1.79% (see Figure 1). Market volatility, as measured by the S&P 500/CBOE option implied volatility, dropped to 18.1% on November 30.

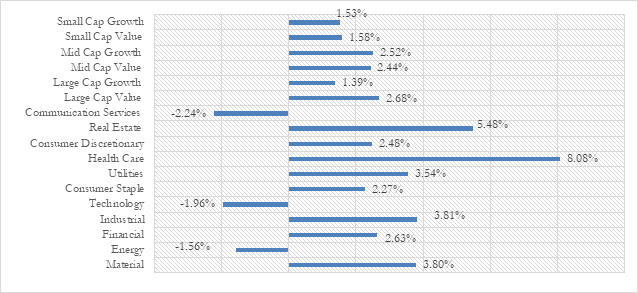

Most of the sectors had positive returns. As the volatility heightened, more defensive sectors outperformed cyclical sectors and value outperformed growth. Healthcare (XLV) and real estate (XLRE) led the rally, up by 8.08% and 5.48%, respectively. The worst performers were technology (XLK) and communication services sector (XLC), down by 1.96% and 2.24%, respectively.

Figure 2: Equity Sector ETF Returns – November 2018

Data Sources: FactSet

Data Sources: FactSet