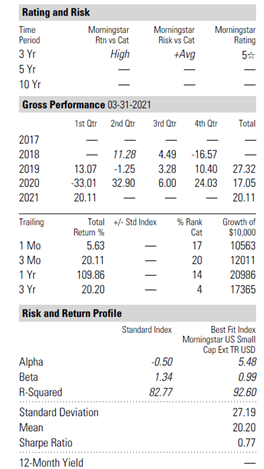

WELLESLEY, MA – May 17, 2021 – Julex Capital Management, LLC., has announced that its quantitative TrueAlpha™ Small Cap strategy is ranked Five Star for its three-year record in the Small Cap Blend category.

“We are pleased that our strong performance has been recognized by Morningstar,” says Dr. Henry Ma, CFA, President and Chief Investment Officer of Julex Capital. “Julex’s small cap stock selection model differs from other quant strategies in two important aspects. First, it aims to deliver alpha uncorrelated with conventional risk factors like value, size, or momentum. Second, it has the potential to outperform the benchmark significantly with a concentrated portfolio. In the current environment, the valuations of small cap stocks are much more attractive than those of large cap stocks. As the economy continues to recover, there is very good chance for small cap stocks to outperform in the near term as well as in the long run.”

TrueAlpha™ Small Cap is a quantitative small cap strategy aiming to deliver “true” stock selection alpha unrelated to risk factors such as value, size or momentum. It normally invests in 20-40 undervalued and high-quality stocks with high profitability and safe balance sheets. The strategy aims to outperform the Russell 2000 Index with high active shares.

The strategy is currently available on Envestnet, TD Ameritrade Model Market Place, Orion Advisor Solutions, Vestmark and Folio Institutional. It can be also available on other BD platform upon clients’ request and through a direct SMA or a model provider relationship.