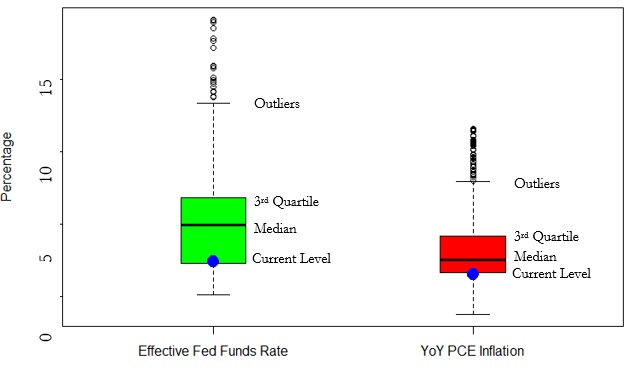

Income conscious individuals have a variety of investment options to choose from including government issued debt, real estate, corporate bonds, and high dividend stocks. While these asset classes are certainly different in many ways, they are similar in that they are subjected to the prevailing interest rates and inflation levels. Inflation erodes the real value of the fixed cash flows generated from the asset, while demand for existing fixed income products move in inverse to interest rates. To put the current environment in historical context, nearly 80% of all months since 1960 have had higher inflation than March’s 1.49%, and almost 75% of all months since 1960 have had higher effective interest rates than March’s 2.41% (see the box plot in Figure 1 below). With both rates and inflation lower than historical norms, it could be beneficial for investors to consider how various income producing assets have performed in different rate and inflation environments.

Figure 1: Historical Distribution of Inflation and Interest Rate Levels

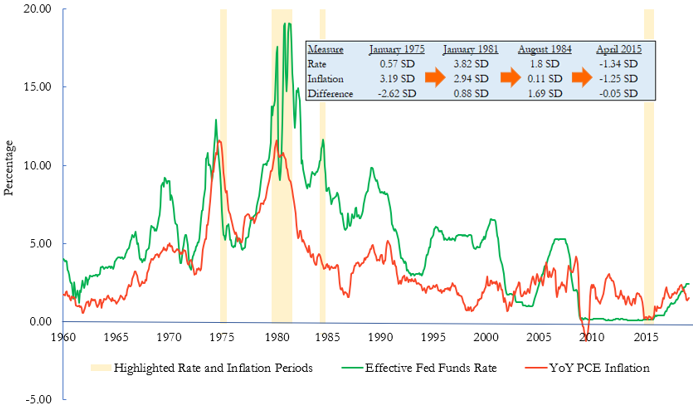

To do so, we’ll highlight four different periods over the last sixty years:

- Low-Rate, Low-Inflation (01/2015-12/2015): While the current levels of inflation and interest rates are low by historical standards, both rates and inflation stood even lower, at about 1.3 standard deviations below their historical average, throughout 2015.

- High-Rate, High-Inflation (10/1979-09/1981): On the other end of the spectrum, the Federal Reserve under Paul Volcker raised rates at an unprecedented pace in an effort to curb the double-digit inflation of the early 1980’s.

- High-Rate, Average-Inflation (04/1984-11/1984): By 1984, inflation had come down in response to the high rates of the era.

- Average-Rate, High-Inflation (11/1974-07/1975): In 1975, remanence of the Arab oil embargo and Nixon’s debasing of the dollar kept inflation high, even as rates were dropping.

Figure 2: Highlighted Inflation and Interest Rate Environments

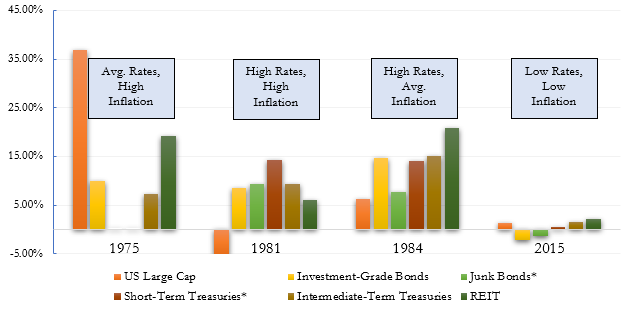

Examining these periods, one can see that:

- Average-Rate, High-Inflation: In 1975, nominal equity returns trumped intermediate treasury offerings and corporate bonds by almost 30%. The upwards of 11% inflation of the time had fixed income instruments returning negative in real terms.

- High-Rate, Average-Inflation: Almost a decade later, the reverse environment occurred as rates sat far above inflation. During this time, government bonds and investment-grade corporates were top performers, generating 14-16% on the year. Junk bonds significantly lagged this group, as high real costs of borrowing likely disproportionately affected companies with already poor credit-quality.

- High-Rate, High-Inflation: Unsurprisingly, the longer-term issuances that performed so well in 1984 didn’t see the same success in the high inflation environment of 1981. Short-term treasuries outperformed the intermediate-term as inflation ate away at the future cash flows of the longer issuances.

- Low-Rate, Low-Inflation: In theory, low rates encourage borrowing. But when consumers are unresponsive to low rates (possibly because they’re busy paying off existing debt), a situation like 2015 might materialize. During that time, REITs (2.22%) outperformed a stagnant equity (1.25%) and treasury (1.50% intermediate-term, 0.45% short-term) market while high-yield bonds (-6.77%) returned negative.

Figure 3: Annual Performance of Various Asset Classes

*No data available for 1975

The above periods help illustrate the variability of seemingly similar assets. To prepare for a multitude of environments, using a tactical product like the Julex Dynamic Income Strategy may help investors appropriately diversify across income-producing assets. The strategy uses momentum to allocate across a wide range of instruments including REITS, Dividend Stocks, MLP’s, Treasuries, Junk Bonds, and Emerging Market Bonds. Since its inception in October 2012, the Dynamic Income Strategy has outperformed the Barlcay’s U.S. Aggregate Bond Index by 2.59% on a gross basis through March 31st, 2019. Given the current environment and the solutions provided with the Julex Dynamic Income Strategy, some investors may see value in using a tactical strategy for their investment options.

Disclosures

Julex Capital Management is a SEC-registered quantitative investment management firm specializing in tactical and factor-based investment strategies. The firm offers a variety of tactical unconstrained investment solutions aiming to provide downside risk management while maximizing the upside potentials using its unique Adaptive Investment Approach. In addition, Julex offers active equity strategies to deliver security selection alpha uncorrelated with the traditional risk factors like size, value or momentum using its TrueAlpha(TM) multi-factor sequential screening approach.

The information in this presentation is for the purpose of information exchange. This is not a solicitation or offer to buy or sell any security. You must do your own due diligence and consult a professional investment advisor before making any investment decisions. The risk of loss in investments can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition.

The use of a proprietary technique, model or algorithm does not guarantee any specific or profitable results. Past performance is not indicative of future returns. The performance data presented are gross returns, unless otherwise noted.

All information posted is believed to come from reliable sources. We do not warrant the accuracy or completeness of information made available and therefore will not be liable for any losses incurred. No representation or warranty is made to the reasonableness of the assumptions made or that all assumptions used to construct the performance provided have been stated or fully considered.