The US stock market has been in a bull run for almost eight years since March 2009. The stock valuation is getting higher and higher as the market continues setting records.

Currently, the 12-month trailing price-earnings ratio of S&P 500 companies is traded at 21.1, which is much higher than the historical average of 16.6 since 1970.

Many market participants are becoming more concerned about this expensive valuation, but others think the stocks are pricey for good reason.

One factor we want to consider is the impact of the current low interest rates on stock valuations. The so-called “Fed Model” simply states that the high PE could be potentially justified if the earnings yield, which is the reciprocal of the PE is significantly higher than interest rates such as of the yield of 10-year government bond.

Currently, the earnings yield (4.7%, which is equal to 1/21.1) is 2.2% higher than the ten-year Treasury rate (2.5%). Then the question becomes: is the earnings yield attractive enough for investors to hold equities?

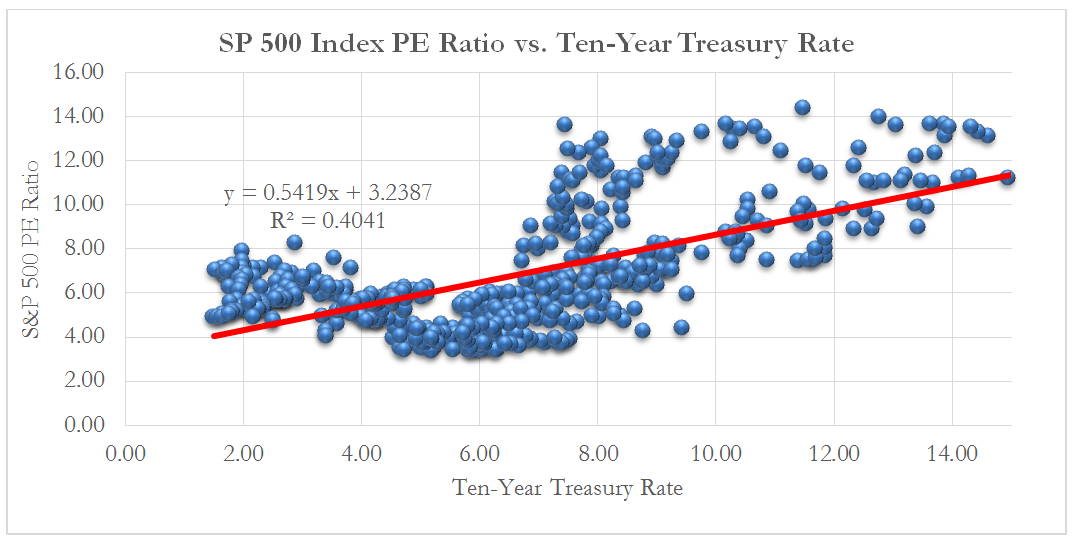

Figure 1 shows the historical relationship between earning yields of S&P 500 Index and ten-year Treasury yield. There is a strong positive relationship between earnings yield and interest rate. When the earnings yield is regressed against ten-year Treasury yield with monthly data since 1970, the equation is estimated as:

Earnings Yield (y) = 0.5419*Ten-year Treasury Yield (x) + 3.2387.

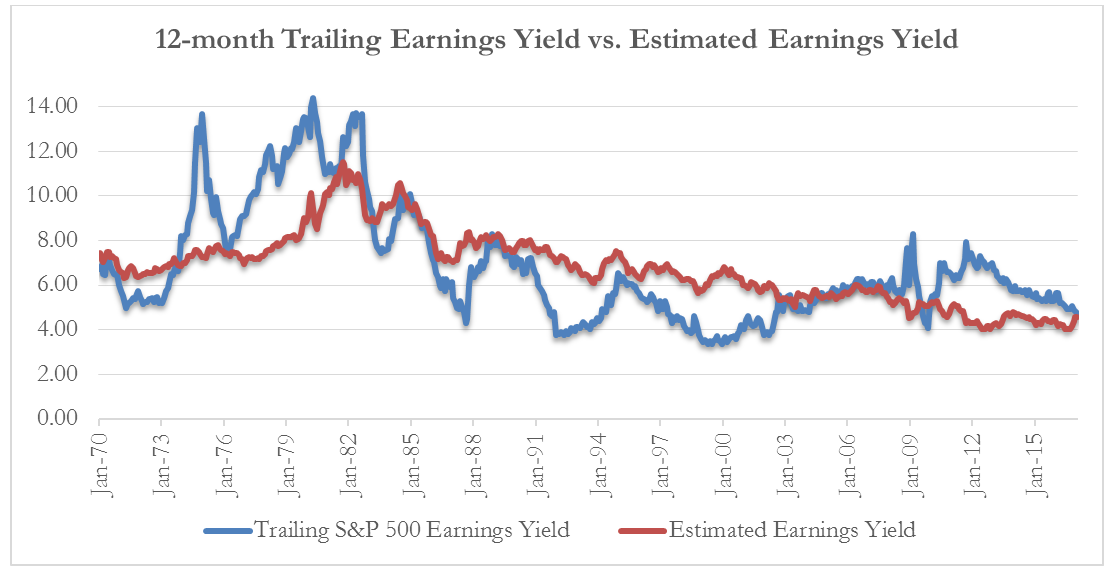

So, based on the Fed model estimates in the equation above, the earnings yield at current interest rate environment should be 4.6%, which is roughly the level where the market is traded now. Figure 2 compares the historical earnings yield with the estimated earnings yield with the Fed model. After eight years of bull market, the US equities are not cheap even after taking into consideration the current low interest rates.

Given the current high PE multiple, it will be hard for the stock market to continue moving higher through PE expansion in the environment of rising interest rates. Thus, earnings growth becomes critically important in determining the future market direction. Trump’s campaign promises on economic policies such as trillion-dollar infrastructure spending, tax cuts and de-regulation can help the economic and earnings growth. However, whether those policies will materialize remains to be seen.

[fny id=”1″]