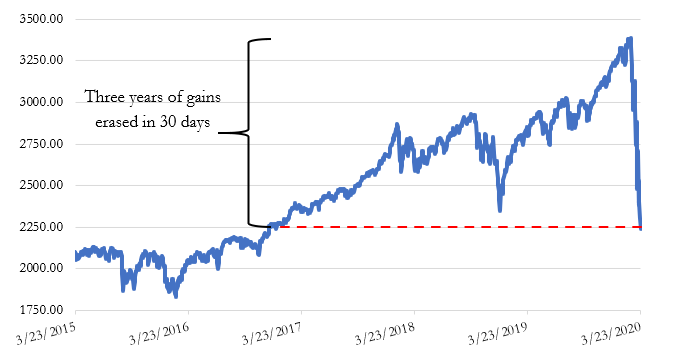

Following the stunning first-quarter sell-off (see Figure 1 below), both the Federal Reserve and Congress took unprecedented actions to mitigate the economic impact of the Coronavirus. The Fed originally cut 50bps off their target rate in a March 3rd emergency meeting, but slashed another 100bps—all the way to zero—just twelve days later. They also tremendously expanded their lending capacity after Treasury Secretary Stephen Mnuchin announced that up to four trillion dollars would be available to businesses struggling to make ends meet amid the lockdown. For their part, Congress passed the CARE Act, which provided an extra $2 trillion in stimulus and a $1,200 check to most Americans. While the speed and scale of these responses are historically unrivaled, it remains to be seen whether or not they can salvage a real economy that’s facing its toughest test since the Financial Crisis.

Figure 1: S&P 500 Index

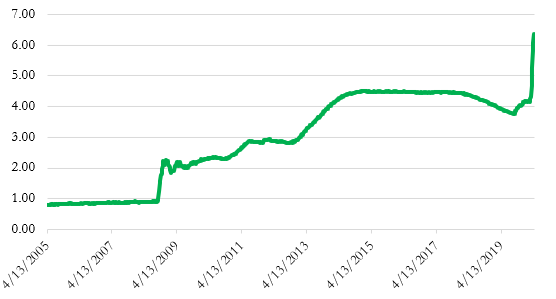

The crux of the issue, of course, is that the sharp reduction in demand accompanying a two-month shutdown isn’t easily replaced in an economy whose hallmark is the consumer. Banks are doing their best though. They’re allowing depository institutions to lend out 100% of their deposits, borrow at a discount rate of 0.25%, and have aggressively started their fourth round of Quantitative Easing. In contrast to normal open market operations, which primarily targets the interest rate by buying/selling short-dated treasuries, Quantitative Easing primarily targets the money supply by buying longer-dated treasuries or more exotic debt such as mortgage-backed securities (or now even broad-based ETF’s). Since cash is a liability to the Federal Reserve, increasing the assets on the Fed balance sheet via Quantitative Easing is analogous with increasing the money supply. Figure 2 below shows the growth of the Fed’s balance sheet over the last 15 years. It is projected to reach $9 Trillion soon.

Figure 2: Weekly Federal Reserve Assets (Trillions USD)

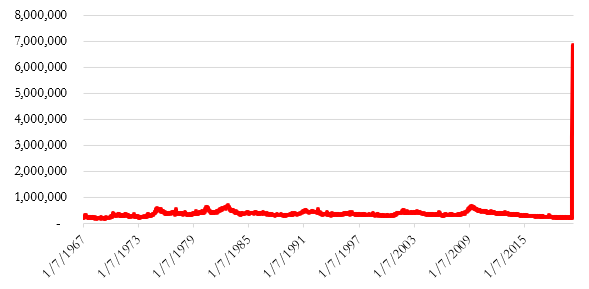

Large scale purchases prop up asset prices but don’t do anything to affect productivity. This has rekindled the perceived divide between Wall Street and Main Street, which was never more evident than when the Dow Jones had its strongest week in nearly half a century despite unemployment claims skyrocketing more than seven times higher than their previous record (see Figure 3 below).

Figure 3: Weekly Unemployment Claims

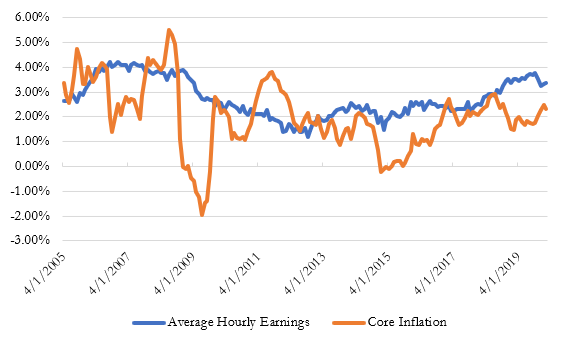

In addition to concerns that helicopter money isn’t a substitute for jobs, some people are worried about the impact that the stimulus will have on inflation. After all, with all this extra money chasing a shrinking amount of goods and services, decreased purchasing power seems like a forgone conclusion. But the Fed has been cutting rates and buying up assets for the last year and consumers still haven’t meaningfully felt any inflation (see Figure 4 below). There are a few possible explanations. The simplest one is that inflation is just hiding in paper assets rather than the physical ones that are counted in calculations such as CPI. Other possible explanations are that wages have been increasing relatively slowly given the stage of the economic cycle, and that the combination of globalization and ecommerce has led to more competition and therefore downward price pressure.

Figure 4: Wage and Inflation Trends (YoY%)

Inflationary concerns aren’t without merit but seem unlikely given people’s lack of spending. The more troubling aspect of the stimulus is the lingering question of its ability jumpstart growth in an economy that’s shedding millions of workers a week. As corporate fundamentals deteriorate, the question on investors’ minds is how long stocks can stay at prices that some were calling expensive a year ago when GDP is set to return to its 2016 levels. With this perspective, it’s possible the stock market could retest the March low again in the next few months. However, as Americans get back to work and regain a sense of normalcy, the optimist in all of us can hope for a relatively quick turnaround.

Disclosure: This article is for the purpose of information exchange only. It is not a solicitation or offer to buy or sell any security. You must do your own due diligence and consult a professional investment advisor before making any investment decisions. All information posted is believed to come from reliable sources. We do not warrant the accuracy or completeness of information made available and therefore will not be liable for any losses incurred.